Review of the facts and the procedure

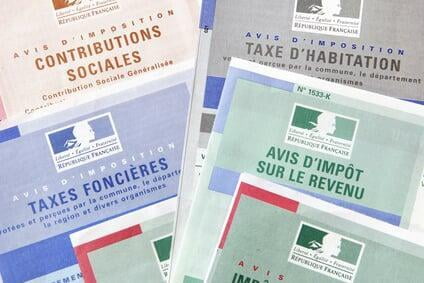

Following a contradictory examination of his personal tax situation and an accounting audit of his poker player activity, the applicant was subject to additional income tax contributions for the years 2009 and 2010, in application of the provisions of article 92.1 of the General Tax Code.

He contested this excess of contributions before the Administrative Court of Paris which rejected his request for discharge of these taxes by a judgment of December 3, 2015.

He therefore appealed to the Administrative Court of Appeal of Paris.

On the application of the Tax Law to poker game winnings

According to article 92 of the General Tax Code:

"Are considered as coming from the exercise of a non-commercial profession or as income assimilated to non-commercial profits, the profits of the liberal professions, of the offices and offices whose holders do not have the quality of tradesmen and of all occupations, exploitations lucrative and sources of profit not related to another category of profit or income".

For the Court, "if the game of poker involves random distributions of cards, a player can, through experience, skill and skill, significantly reduce the randomness of the outcome and significantly increase his probability of receiving winnings important and regular".

Thus, if a person engages in a habitual practice of this game with the intention of profiting from it, said profits must be regarded as derived from a lucrative occupation or from a source of profit within the meaning of the provisions of the '' article 92 of the general tax code, and taxable in application of this article

The judges also reject the applicant's argument that the poker player was subject to double taxation of his income as a result of the payment of taxes which are, however, "not sitting on gambling winnings according to the Court".

Considering, in particular, "that he did not receive any professional income during the two years in question", having regard to the habitual nature of this activity which generates significant income, and even though the person concerned has only participated in seven tournaments during the years concerned, other players would have much higher incomes, and that sponsorship operations of the type in question are advertising operations carried out by the sponsors, the player "must be regarded as having exercised, during the two years in question, a lucrative poker player activity providing him with regular taxable profits in the category of non-commercial profits in application of the aforementioned article 92".

On the benefit of administrative doctrine

The player avails himself of the basic documentation 5 G 116 (n ° 118) of September 15, 2000, under the terms of which:

"The practice, even usual, of games of chance such as lotteries, raffles or various games, does not constitute a lucrative occupation or a source of profits which should give rise to taxation on behalf of the persons participating in these games.".

Nevertheless, the judges indicate "that the doctrine thus invoked, which the tax judge is required to make a literal application, without engaging in its interpretation, does not mention the game of poker and does not define the concept of game of chance".

Furthermore, "lthe circumstance that the administrative doctrine has evolved after the taxation years, in the sense of the taxation of winnings made in poker in a professional context, is in any event inoperative".

Also the poker player's claim is dismissed by the Court of Appeal.