Financial gains from the usual practice of poker

Reminder of the facts of the decision

A poker player had given up his job to devote himself to the practice of poker, especially in competition. However, by participating in more than twenty competitions a year, the latter had the quality of a professional player.

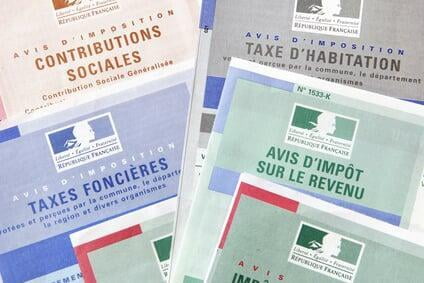

When examining the player's personal tax situation, the administration considered as Non-Commercial Profits (BNC) taxable on the basis of the provisions of Article 92 of the General Tax Code, the income earned by the person concerned of his activity as a poker player.

Article 92 of the General Tax Code

1. Are considered as coming from the exercise of a non-commercial profession or as income assimilated to non-commercial profits, the profits of the liberal professions, of the charges and offices whose holders do not have the quality of traders and of all occupations , lucrative exploitations and sources of profits not related to another category of profits or income.

2. These benefits include in particular:

1° Proceeds from stock market transactions carried out under conditions similar to those characterizing an activity carried out by a person engaging in this type of transaction on a professional basis;2° Income from royalties received by writers or composers and by their heirs or legatees;3° Income received by inventors under either the granting of licenses to exploit their patents, or the assignment or concession of product or service marks, processes or manufacturing formulas;4° Discounts granted for the sale of manufactured tobacco;5° Income from transactions carried out on a regular basis, directly, through an intermediary or through a trust, on financial contracts, also referred to as "futures financial instruments", mentioned in III of Article L. 211 -1 of the Monetary and Financial Code, when the option provided for in 8° of I of Article 35 was not open to the taxpayer or when he did not exercise it;6° The sums and indemnities received by the arbitrators or judges in respect of the arbitration mission mentioned in Article L. 223-1 of the Sports Code;7° Sums received by lawyers in their capacity as fiduciary of a trust transaction defined in Article 2011 of the Civil Code.

3. The profits made by court clerks holding office are taxed, according to the rules applicable to the profits of offices and offices, according to their net amount determined after deduction of the salaries and allowances allocated to court clerks by the State. These salaries and allowances are placed in the category referred to in V of this sub-section.

Taxation of poker winnings in the category of BNC (Non-Commercial Profits)

Article 92 of the aforementioned CGI provides in particular that:

"Are considered as coming from the exercise of a non-commercial profession or as income assimilated to non-commercial profits, the profits of the liberal professions, of the charges and offices whose holders do not have the quality of traders and of all occupations, lucrative farms and sources of profit not connected with another category of profits or income"

In this respect, the mere practice of games of chance does not in itself constitute a lucrative occupation or a source of profit within the meaning of Article 92, solely because of the hazard attached to the player's prospects of winnings.

Nevertheless, the Council of State considered that it was different for "la habitual practice of a game of money between a player and opponents, when it allows the latter to significantly control the inherent randomness of this game, through the qualities and know-how that it develops, and provides it with significant income ".

The judges recalled in this respect that thanks to a certain experience developed by the player, in particular through the analysis of the game and his opponents, it was possible to control randomness and therefore increase the likelihood of receiving winnings.